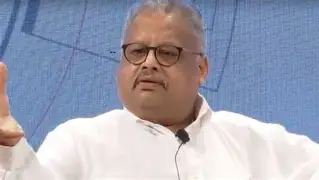

Rakesh Jhunjhunwala: From Short Seller to India’s Big Bull

Rakesh Jhunjhunwala, also known as the Big Bull of Indian Stock Market, is one of the most iconic names in India’s financial world. His journey from trading small lots as a short seller to becoming a long-term value investor with a portfolio worth over ₹40,000 crore is not just inspiring — it’s a roadmap for anyone dreaming of stock market success.

While many know him as a billionaire investor, few truly understand how he transformed his investment style from chasing quick gains to patiently building wealth through long-term investing in high-growth Indian companies.

Early Days: A Curious Mind, A Risk-Taker at Heart

Rakesh Jhunjhunwala was born in Mumbai in 1960 to a middle-class family. His father, an income tax officer, often discussed stock market trends at home. This sparked young Rakesh’s curiosity about investing. While studying Chartered Accountancy, he decided to step into the stock market using his own savings — just ₹5,000 — in 1985, when the Sensex was below 150.

In those early years, Jhunjhunwala started as a trader, and not just any trader — he was a short seller. That means he often bet on the decline of stock prices, taking positions that profited when the market went down. He would borrow shares, sell them, and buy them back at lower prices to earn a margin.

Why? Because short-selling gave quicker results and was suited to his limited capital. He studied market sentiments, news, and short-term trends, and took fast positions to build up some early gains.

Trading Triumphs: From Tata Tea to the Harshad Mehta Crash

One of his earliest and most famous trades was in Tata Tea. He bought 5,000 shares at ₹43, expecting the stock to benefit from rising demand and an undervalued price. Within months, it tripled, and he booked his first big profit.

Then came the Harshad Mehta scam in 1992. While the entire market was riding high on speculative stocks, Jhunjhunwala saw the underlying risk and began short-selling several overvalued companies. When the market crashed, he made a fortune, while others suffered massive losses.

This success proved two things:

- He had a sharp sense of timing and market psychology, and

- He wasn’t afraid to go against the herd.

But something was changing within him.

Evolution: From Trader to Long-Term Investor

Even though Jhunjhunwala was successful as a short-term trader, he realized that real wealth in the stock market wasn’t made by timing tops and bottoms — it was made by owning great businesses over long periods of time.

This mindset shift didn’t happen overnight.

He started studying the portfolios of global investors like Warren Buffett, who believed in value investing — the art of buying strong companies at a fair price and holding them for decades. Jhunjhunwala began spending more time reading annual reports, analyzing balance sheets, studying management quality, and understanding macro trends in the Indian economy.

He slowly moved away from trading frequently to investing in companies with high growth potential. The goal was no longer “quick money” — it was “long-term wealth creation.”

Legendary Long-Term Investments That Defined His Career

Titan Company

The best example of this transition is his legendary investment in Titan. He started buying Titan shares when they were trading around ₹3 (adjusted price). While analysts were skeptical about its future, Jhunjhunwala believed India’s rising middle class would embrace branded jewelry and watches. Titan became his crown jewel — worth over ₹10,000 crore at its peak.

Lupin

He invested early in Lupin, a pharmaceutical company, recognizing the potential of India’s generics sector in global markets. Over time, it gave him multi-fold returns.

CRISIL

His stake in CRISIL, a credit rating agency, was based on a deep understanding of India’s evolving financial ecosystem and regulatory needs. He stayed invested in CRISIL for years.

These were no longer just stocks for him. They were businesses he believed in, and he wasn’t afraid to stay invested even during bear markets.

Key Investment Philosophy: Mind Over Market

Jhunjhunwala believed the stock market is a game of emotions, not just numbers. He often said, “Be optimistic. Optimism is the fuel of investing.” His investment principles included:

- Conviction: Don’t panic when prices fall if the business is strong.

- Patience: Great returns take time. He held Titan for more than 15 years.

- India growth story: He always said, “India’s best is yet to come.”

He didn’t believe in chasing fads or hype. Instead, he invested in sectors that would benefit from India’s long-term growth — like banking, insurance, pharma, consumption, and infrastructure.

Businessman and Mentor in Later Years

As his fortune grew, Jhunjhunwala diversified. He founded Akasa Air, backed Indian startups, and supported emerging entrepreneurs. He also inspired thousands of retail investors with his interviews, speeches, and investor conferences.

His approach was direct, full of humor, and practical. He wasn’t shy to admit his mistakes, often saying, “I’ve made more wrong decisions than right ones, but my right ones made me richer.”

Final Thoughts: Why His Story Still Matters

Rakesh Jhunjhunwala passed away on August 14, 2022, but his legacy is alive in every Indian investor who believes in long-term wealth, not overnight riches.

His journey from a short-selling trader to a long-term value investor is the best example of how investing is not just about money — it’s about learning, adapting, and evolving. He showed us that even with limited capital, if you have discipline, vision, and courage, you can create extraordinary wealth.

Whether you’re a new investor or a seasoned one, ask yourself — are you playing the short game, or are you ready to play the long game, like India’s Big Bull?

1 comment