Smart Investing: Why Diversification Is the Key to Building Wealth in India

Building wealth is not just about earning more — it’s about investing smart. One of the biggest mistakes new investors make is putting all their money into one place. In reality, the smartest investors in India follow a strategy called diversification, which simply means spreading your money across different investment options in India like stocks, mutual funds, gold, and real estate. This not only helps reduce risk but also increases the chances of long-term success.

Let’s imagine you’re a 30-year-old professional earning a stable income. Instead of throwing all your money into the stock market, hoping to “get rich quick,” a better approach would be to create a balanced investment portfolio. Start with mutual funds through SIPs — they’re beginner-friendly, low-maintenance, and offer great long-term returns.

Start with SIPs: Simple, Powerful, and Proven

A SIP (Systematic Investment Plan) of just ₹2,000/month in a good equity mutual fund could grow into several lakhs over 20 years, thanks to the power of compounding. This strategy is perfect for those who want to build wealth in India without actively tracking the market every day.

SIPs are one of the best investment options in India for salaried individuals. They are designed to be automatic and disciplined, helping you stay consistent even when markets are volatile. Whether you’re saving for a house, retirement, or your child’s education, SIPs can help you reach those goals with less stress and more structure.

Add Stocks for Higher Growth Potential

But you shouldn’t stop at mutual funds. Directly investing in stocks adds growth potential to your portfolio. Stocks carry more risk but can offer multibagger returns if you do proper research or follow expert advice.

Sectors like pharma, electric vehicles (EV), and chemicals have shown massive long-term returns. Companies such as Tata Motors, Dr. Reddy’s, Deepak Nitrite, and Divi’s Labs have made fortunes for long-term investors who had patience.

If you’re not confident yet, start small or stick to large-cap stocks or ETFs (Exchange-Traded Funds) that track indices like the Nifty 50 or Sensex. This gives you exposure to the broader market with less individual risk.

SEO keywords added: best stocks to invest in India, stock market tips, multibagger stocks, stock market investing for beginners, Nifty 50 ETF, Sensex investment

Gold: The Smart Safety Net

Next, add some gold to your strategy — not because it’s shiny, but because it’s a great hedge against inflation and market volatility. It also performs well when equity markets are down.

Instead of buying physical gold, consider Sovereign Gold Bonds (SGBs) or Gold ETFs, which are safer, tax-efficient, and easy to manage. These digital gold formats also eliminate the risks of theft and storage.

Allocating around 10% of your portfolio to gold can help you maintain balance during market fluctuations and currency devaluation.

SEO keywords added: how to invest in gold India, gold ETF vs SGB, benefits of digital gold, inflation hedge investment

Real Estate: The Long-Term Wealth Creator

Don’t ignore real estate — especially if you’re thinking long-term. While buying property requires a larger investment, it offers steady appreciation and rental income. It’s also a great way to diversify beyond financial assets.

If direct property seems out of reach, consider REITs (Real Estate Investment Trusts). These allow you to invest in commercial real estate projects with smaller amounts and earn dividends through rental income — without actually owning the property.

Over time, real estate can offer inflation-beating returns while adding stability to your portfolio.

SEO keywords added: real estate investment in India, REITs India, property investment options, rental income assets

Asset Allocation: The Blueprint of Smart Investing

All of this comes together in a technique called asset allocation — deciding how much of your money goes where, based on your risk profile and financial goals.

For example, a balanced asset allocation strategy for Indian investors could look like:

- 40% mutual funds (SIPs)

- 20% direct stocks

- 20% real estate or REITs

- 10% gold (SGBs or ETFs)

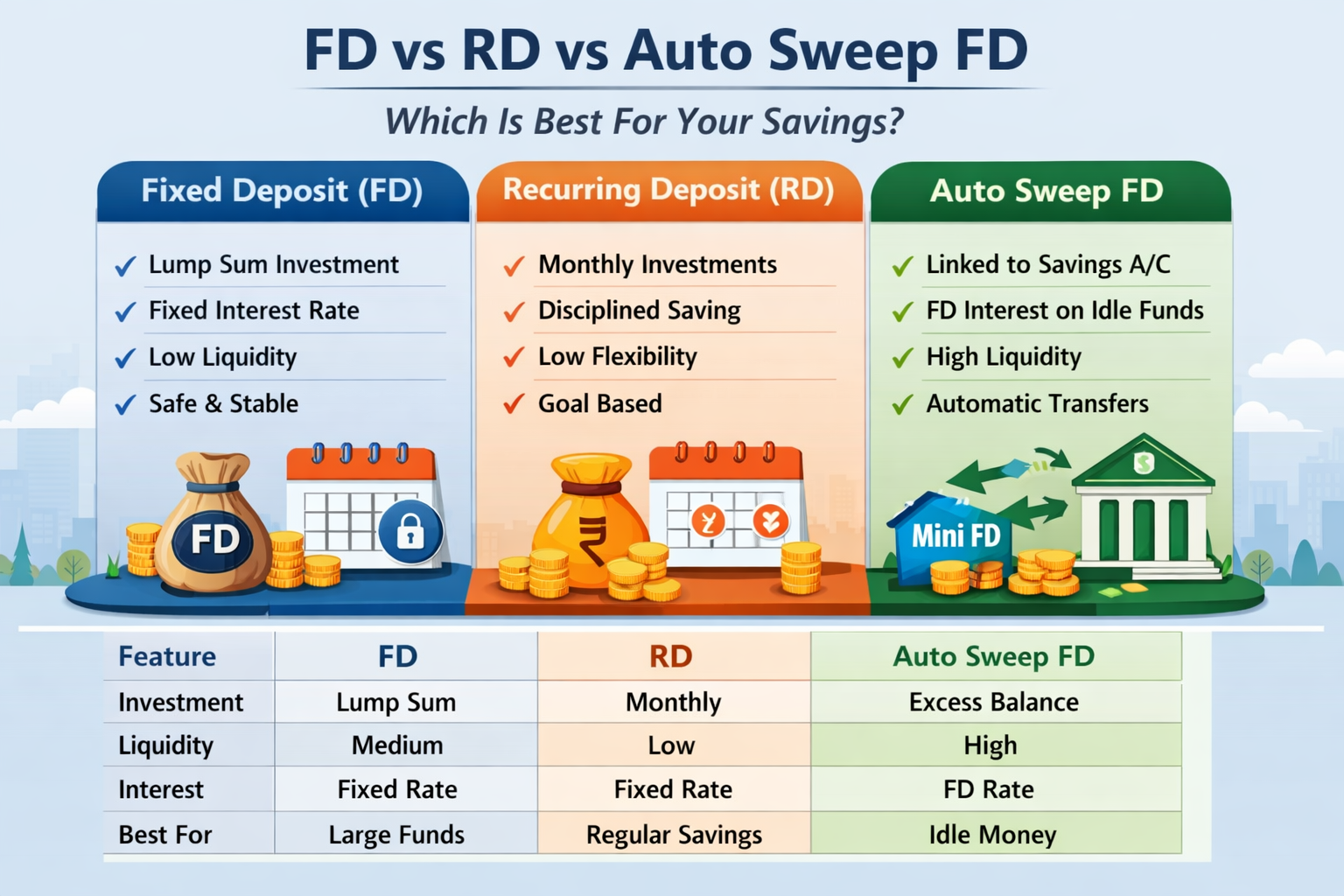

- 10% fixed income (FDs, PPF, or bonds)

This diversified mix creates a strong base for long-term wealth creation, while protecting you from overexposure to any single asset class.

Rebalancing: Maintain Balance as You Grow

Another step often recommended is rebalancing your portfolio every year, especially if one asset grows too fast or underperforms.

For example, if the stock market booms and your equity share grows to 70% of your portfolio, rebalancing helps you bring it back to your desired level by shifting profits into safer assets like fixed deposits or gold.

While rebalancing may feel like a small adjustment, it plays a big role in reducing risk and locking in gains.

SEO keywords added: how to rebalance portfolio, investment planning India, reduce investment risk, financial planning strategies

Time Is Your Best Friend

The real magic happens when you stay invested for the long term. Time is your biggest ally in investing. The longer you stay, the more your wealth grows — thanks to compound interest, dividends, and capital appreciation.

Many Indian investors who began small SIPs in the early 2000s are now sitting on portfolios worth lakhs and even crores — not because of timing the market, but because they stayed in the game.

Final Thoughts: Wealth Without Stress

Smart investing isn’t about luck — it’s about planning, balancing, and staying patient.

By creating a diversified strategy with mutual funds, direct stocks, gold, real estate, and fixed income, and sticking with it long-term, you can build real, lasting wealth — without anxiety, without daily market tracking, and without the fear of losing everything in one crash.

Start with what you have. Start today. Let your money grow across different paths — and watch your financial future take shape with confidence.

Written by Badri | MoneyScope360

360° of Money, Markets & Motivation

Post Comment