Why Passive Income Is Crucial in 2025

Lessons from Virat Kohli’s Financial Playbook

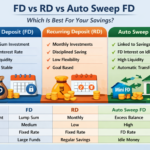

In 2025, having multiple passive income streams is no longer a luxury — it’s a financial necessity. With increasing job market volatility, rising inflation rates, and economic uncertainty, depending solely on a single salary or active income source has become a high-risk strategy. Passive income ideas such as rental property, dividend-paying stocks, mutual funds, online businesses, and royalties offer stability, freedom, and long-term wealth-building opportunities. It allows you to earn money while you sleep, creating a reliable financial cushion during unexpected events like layoffs, health issues, or market downturns. This income diversification not only protects your future but also empowers you to choose where and how you invest your time, energy, and money.

Take the example of Virat Kohli, India’s most influential sports personality and a living example of modern financial intelligence. As of 2025, Kohli’s net worth has crossed ₹1,050 crore (approximately $126 million), making him one of the richest athletes in India. While his cricketing career brought him fame and initial earnings, it’s his business investments, startup funding, and brand ownership that turned him into a long-term wealth creator. Kohli has built a wide range of passive income sources by investing in fast-growing Indian startups like Rage Coffee, Blue Tribe Foods, Digit Insurance, and Sport Convo, while also owning and co-owning high-growth brands such as WROGN, One8 Commune, and Chisel Fitness. His ventures in restaurants, fashion, health, and tech reveal a strong grasp of recurring revenue models, brand monetization, and financial sustainability.

Moreover, his diverse portfolio includes co-ownership of sports franchises like FC Goa, UAE Royals, and Bengaluru Yodhas. His early investment in Digit Insurance paid off substantially after its IPO, proving the power of smart equity investing. Kohli doesn’t just endorse brands — he builds equity in them, unlocking royalties, dividends, and brand licensing revenue. This is a shift seen in many celebrity entrepreneurs, where influence is converted into equity and long-term passive returns.

This trend isn’t exclusive to celebrities or millionaires. In fact, anyone in India or globally can build passive income, starting with minimal capital and a solid plan. Whether you’re investing in SIPs, index funds, affiliate marketing, digital products, or YouTube automation, there are now more tools than ever to create multiple income streams. What matters is starting early, staying consistent, and thinking long-term. Even modest investments today can snowball into meaningful cash flow tomorrow.

In today’s digital and economic landscape, financial freedom isn’t just about earning more — it’s about building a sustainable income architecture that works for you. Kohli’s transition from cricket star to investment mogul isn’t just inspiring — it’s a financial blueprint. His journey proves one thing: if you want to secure your financial future, you must diversify your income, invest smartly, and create streams that pay you even when you don’t work.

Diversify your income. Secure your future. That’s the power of multiple passive streams.

“Don’t work for money. Let your money work for you.” – Robert Kiyosaki

Post Comment