Emergency Fund India: How Much to Save in 2025

What would you do if you suddenly lost your job tomorrow? Or if a massive medical bill came your way out of nowhere?

Most people panic. Some take high-interest personal loans. Others break their long-term investments like PPF or mutual funds. But financially smart people? They stay calm — because they have an emergency fund in place.

In 2025, with rising inflation, job uncertainty, and healthcare costs in India, building an emergency fund is not optional — it’s your financial life jacket. Whether you’re a salaried employee, freelancer, or small business owner, an emergency fund protects your money and your mental peace.

What is an Emergency Fund?

An emergency fund is a dedicated amount of money set aside for life’s unexpected events — things that you didn’t plan, but can’t afford to ignore. It’s not meant for vacations, luxury shopping, or weekend getaways. It’s strictly for urgent and unexpected financial needs.

Situations where emergency funds help:

- Job loss or delayed salary

- Medical emergencies or hospitalization not covered by insurance

- Sudden car or home repair

- Family crisis or emergency travel

- Natural disasters or loss of income due to strikes, layoffs, etc.

Think of it as personal insurance that you control — with no premium, no paperwork, and instant access when needed.

How Much Emergency Fund Do You Need in India?

There’s no single formula, but most financial experts recommend saving:

3 to 6 months’ worth of essential living expenses

Let’s break it down:

- If your essential monthly expenses (rent, food, EMI, bills) are ₹35,000

- You should aim for ₹1,05,000 to ₹2,10,000 in your emergency fund

If you’re self-employed, running a small business, or working in a volatile job market (like startups, media, tech), go a step further — build 6 to 9 months’ worth of reserves.

👉 This approach is called emergency fund calculation, and it’s the first step in proper personal financial planning in India.

Where to Keep Your Emergency Fund in India?

A good emergency fund is not only about how much — but also about where.

Your fund must be:

- Safe (principal-protected)

- Liquid (easy to access anytime)

- Separate (not linked to your daily use account)

Best options to store your emergency fund in India (2025):

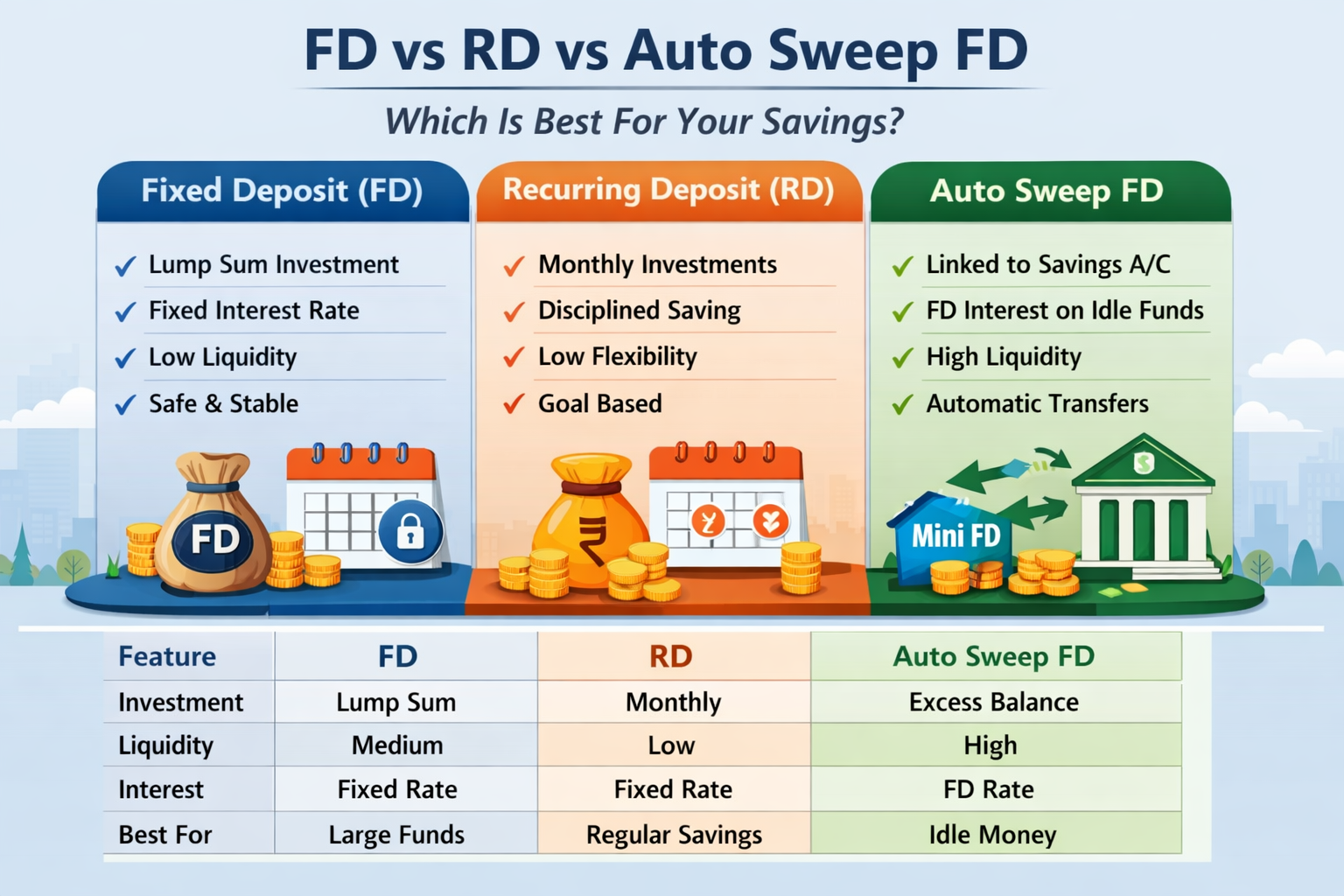

- High-Interest Savings Account

Banks like IDFC First Bank, AU Small Finance Bank, and Kotak Mahindra Bank offer 6–7% interest with easy withdrawal and no risk. - Liquid Mutual Funds

These are ultra-short-term debt funds that offer 5–6.5% returns with next-day liquidity. Use apps like Groww, Kuvera, or Zerodha Coin to invest. - Sweep-in Fixed Deposits

This FD auto-breaks if your balance drops, giving you higher interest than a regular savings account. - Recurring Deposit (RD)

For those who prefer fixed monthly saving habits. Low risk, predictable growth.

Avoid:

- Stock market or equity mutual funds (high risk)

- Long-term FDs (penalty on early withdrawal)

- Real estate or gold (not liquid)

This is your emergency money — not your investment portfolio.

How to Build an Emergency Fund in India Step by Step

Most people think they need to save lakhs overnight — but that’s not true. Start small. Stay consistent.

Step-by-step plan:

- Month 1–3: Save 1 month’s expenses

- Month 4–6: Build up to 3 months

- Next 6 months: Hit your 6-month savings target

Use bonuses, tax refunds, Diwali gifts, or freelance income to fast-track your progress. Even saving ₹5,000 per month adds up over time.

Set up a SIP in a liquid fund or an auto-debit to an RD or sweep account. Let the savings run in the background.

Why Emergency Funds Matter More in 2025

India’s financial landscape is shifting:

- Job security is falling, even in MNCs and startups

- Medical inflation is above 12% annually

- One-income households are vulnerable

- Economic shocks — like pandemic, wars, and policy changes — hit without warning

In such a situation, depending only on credit cards or family support is dangerous. You need your own cushion.

An emergency fund gives you:

- Freedom to take time between jobs

- Confidence to handle medical bills without debt

- Emotional peace during life’s toughest moments

- Stability to continue your SIPs and investments without pausing

Common Mistakes People Make

Avoid these at all costs:

- Using credit cards or personal loans as emergency backup

- Parking funds in risky instruments like stocks or crypto

- Keeping emergency funds in the same account you use daily

- Ignoring inflation while setting your fund target

Also, don’t treat an emergency fund like a fixed deposit. It’s not about returns — it’s about readiness.

Bonus Tip: Label Your Fund for Psychology

Open a separate savings account or folio. Name it something like “Emergency Only – Do Not Use.”

Psychologically, this reduces your temptation to dip into it for non-urgent spending.

Out of sight = out of mind. But still available when life throws a surprise.

Final Thoughts: Build First, Then Invest

Many young Indians want to jump into SIPs, stocks, and crypto. But before you grow wealth, you need to protect your base.

An emergency fund is your foundation.

To recap:

- Save 3–6 months’ worth of essential expenses

- Keep it in a safe and liquid instrument

- Start with small steps, automate it

- Don’t mix with regular savings or use it for lifestyle goals

- Review it yearly and adjust for inflation

If life throws you a financial shock tomorrow… are you ready?

Build your emergency fund today — your future self will thank you.

Written by Badri | MoneyScope360.com

Bringing money clarity to everyday life.

Post Comment